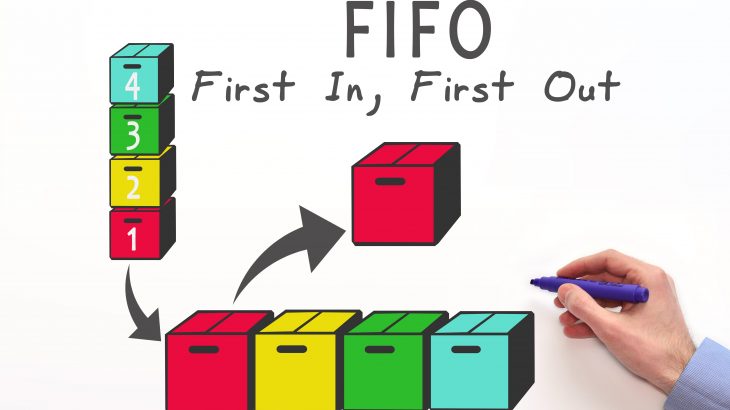

FIFO (first in, first out) is an inventory method based on the idea that the first goods entered in the inventory will also be the first to be sold. Companies or stores that implement this method adopt the strategy to first sell the first units introduced into the system to streamline spending.

This method results in an increase in the final inventory value in periods of inflation.

FIFO Principles

The FIFO merchandising rule is based on the introduction of actual costs associated with inventory products into the system. The costs are attributed to a product depending on how popular it was. According to this method, the popularity (product rank) will be equal to the order of introduction into the system (first introduced, first used).

FIFO rules are useful when the stores want to first sell the first products entered into the inventory and then continue with those received recently.

This method assigns the associated costs according to the order of introduction, as follows: If 100 products with value X were purchased and then 100 of products with Y value were purchased, the first introduced method will assign the value of the first 100 pieces, then switching to the following 100. This process is followed even if other inventory purchases are carried out along the way.

The idea of commercializing stocks according to age works for products with seasonal inventories such as clothing or housekeeping items and refers less to companies with inventory in the field of technology, for example.

Our merchandising team can help you implement this calculation method.

FIFO method compared to other valuation methods

A consequence of using the FIFO method is that the final inventory balance will have a higher value due to inflation and price fluctuation. Older prices will have a lower value than the value with which the newest inventoried product is registered (which has a value corresponding to current inflation). Thus, this method of calculation can generate a higher net income.

An alternative to FIFO is just the opposite of it, LIFO ("Last in, first-out"), which is based on the assumption that the latest products placed in the inventory will be the first to be sold. The average cost is a technique based on calculating the average value for all products in the inventory.

Inventory valuation is important for many stores and companies. Inventory costs are part of the costs that include the goods sold and the use of an appropriate calculation method and it's important for the company's overall financial balance.

FIFO method can bring results or not depending on the type of product that is in stock, each product category being applied a particular method. You can contact us for more information about merchandising and inventory techniques.